irs tax levy calculator

Follow steps 1-4 to calculate disposable pay. Information About Wage Levies.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

If you have a tax debt the irs can issue a levy.

. Employers generally have at least one full pay period after receiving a notice of levy on wages. The penalty for not doing your taxes is typically around 5 of the tax you owe increasing by 5 each month until reaching a maximum failure to file penalty of 25. It is different from a lien while a lien makes a claim to your assets as.

The levy is released. The Department may issue a tax levy against the wages of any taxpayer who has failed to pay their taxes after a Final Notice and Demand for Payment is issued. A levy is a legal seizure of a taxpayers property to satisfy a tax debt.

A calculator requires very few details to work. Irs issues notice of intent to levy in a letter numbered cp504 asking you to pay the tax due within 10 days of service of that letter. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Irs tax levy calculator. Go to the online payment agreement application page on IRSgov. One year for 120.

Get A Free IRS Tax Levy Consultation. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. Calculate Social Security tax at 42 percent of gross income and Medicare tax at 145 percent.

This will help you make sure you have the right amount of tax withheld. Irs Tax Levy Calculator. As an employer when you receive a notice of levy from the federal government youll need to calculate the amount of the employees pay.

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. As soon as latest 2026 tax year relevant tax data is released this tool will be. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Use the IRS Circular Es tax withholding tables to calculate federal income tax. For employees withholding is the amount of federal income tax withheld from your paycheck. If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until.

Get free competing quotes from leading IRS tax levy experts. IRS tax forms. The result will be the maximum new tax you would pay.

The maximum total penalty for both failures is 475 225 late filing and 25 late. When an individual has outstanding. With a tax levy the IRS confiscates assets of yours such as the money in your savings account or a portion of your wages.

Both reduce your tax bill but in different ways. Multiply the levy millage by 001. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

Tax credits directly reduce the amount of tax you owe dollar for dollar. Of course an IRS levy doesnt happen overnight. Ad Find 100s of Local Tax Experts.

Multiply this number times the assessed valuation. Thus the combined penalty is 5 45 late filing and 05 late payment per month. Part of your wages.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck. Trial calculations for tax owed per return over 750 and under 20000.

A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy. How to Calculate Wage Tax Levy. What is the IRS tax levy calculation.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Dont Face the IRS Alone. The IRS can take as much as 70 of.

Estimate how future Income will impact your Taxes. Enter dollar amounts without commas or. Ad Apply for tax levy help now.

A tax levy is a legal seizure on wages to satisfy a tax debt. Eg if the levy is 42 mills the result is 0042. Create an account with IDme and have your photo identification ready drivers license state ID or passport.

IRS Levies Expert Can Help. CDOR will usually send a. The penalty is 05 of the additional tax amount due and not paid by the due date for every month or portion thereof that the additional tax amount is not paid.

The amount of income tax your employer withholds from your regular pay. Whatever You Need Find it on Bark. The IRS encourages everyone to use the Tax Withholding Estimator to perform a paycheck checkup.

Pay Period Frequency select one Select from below. This Calculator is currently based on 2021 tax year tax tables.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Tax Notices Explained Landmark Tax Group

Irs Notice Cp504 Understanding Irs Notice Cp504 Notice Of Intent To Levy Immediate Response Required

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Should You Move To A State With No Income Tax Forbes Advisor

Irs Tax Resolution Oklahoma City Back Tax Returns Tax Debt Relief

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Understanding The Economic Effects Of Federal Tax Changes Equitable Growth

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Who Do I Call About An Irs Tax Levy

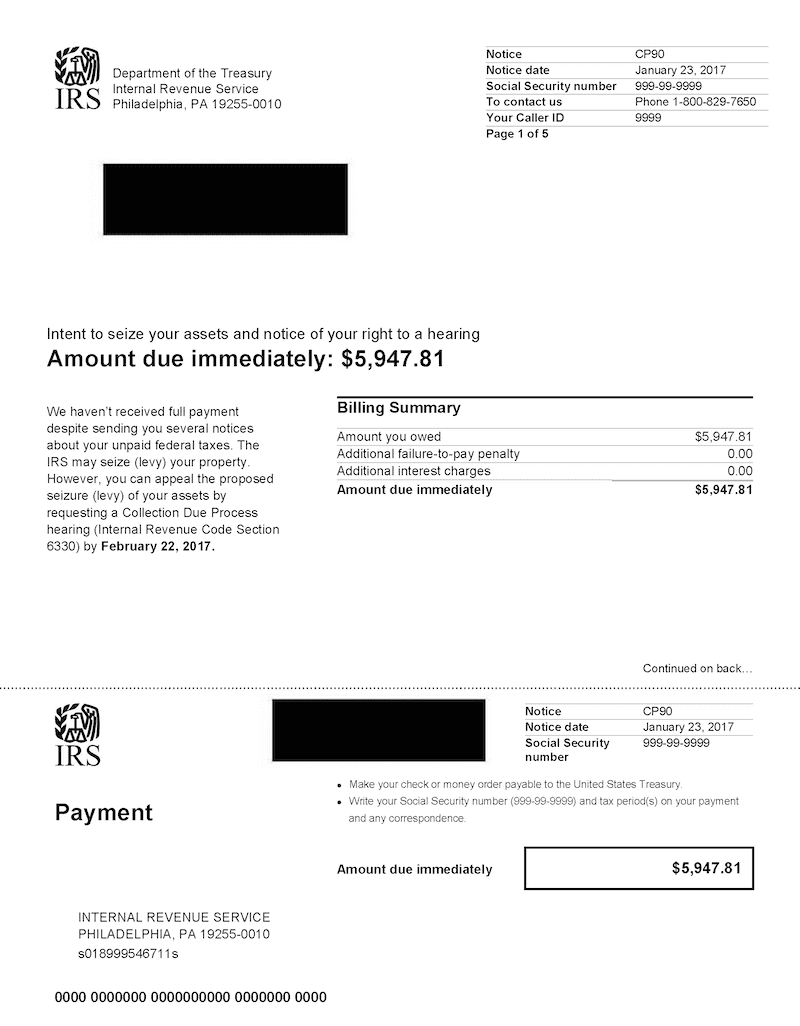

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block